Automating and Optimizing Sarbanes-Oxley (SOX) Compliance in Modern Financial Systems for Efficiency, Security, and Regulatory Adherence

Shinoy Vengaramkode Bhaskaran

Senior Big Data Engineering Manager, Zoom Video Communications.

https://orcid.org/0009-0008-0726-5403

Keywords: automation, compliance processes, data analytics, financial systems, machine learning, Sarbanes-Oxley (SOX), technological advancements

Abstract

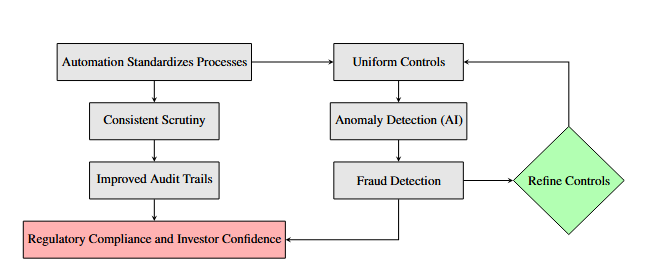

Automating and optimizing Sarbanes-Oxley (SOX) compliance processes in modern financial systems drives significant improvements in operational efficiency, data integrity, and regulatory adherence. Compliance with SOX, established to restore investor confidence and reduce corporate malfeasance, demands robust internal controls, transparent reporting, and rigorous oversight. Manual processes, prone to human error and time-intensive checks, have long posed challenges for organizations striving to meet changing standards and secure stakeholder trust. The increasing complexity of financial environments, characterized by intricate data flows, diverse third-party integrations, and rapidly changing accounting principles, requires a more streamlined approach that integrates regulatory requirements directly into automated workflows. Technological advancements offer an array of methods that enhance both the efficiency and the accuracy of compliance operations. Robotics process automation automates repetitive and rule-based tasks, enabling a more precise approach that reduces errors and expedites completion. Machine learning algorithms identify anomalies, suggest continuous improvements, and create dynamic controls that adapt to organizational changes. Data analytics tools consolidate and analyze large datasets to provide predictive insights, support management’s decision-making, and ensure that processes align with control objectives. Integration of these technologies within existing financial systems aligns compliance strategies with legacy infrastructures and organizational cultures, ensuring that employees adapt and embrace new methods. Emphasis on continuous monitoring and real-time reporting further ensures that compliance functions operate as integral components of daily operations rather than as periodic assessments. This paper examines critical aspects of automating SOX compliance, including the role of robust controls, process efficiency, and the benefits of embedding advanced technologies. The discussions elaborate on the strategic outcomes that arise from an automated compliance environment, shows the necessity of transparency, and highlight how organizations achieve greater stability, scalability, and adherence to regulatory expectations through technology-driven transformations.